Invoice Like a Pro: A No-Nonsense Guide to Getting Paid on Time

Published on: by: Chip Olson

A friend of mine, a very talented commercial photographer, once called me in a panic. He was great at his craft and had successfully secured five clients on monthly retainers. By all accounts, his business was a success. But when we looked at his books, he was on the verge of running out of operating capital. The reason was simple: all five of those clients were 90 days past due on their invoices.

He was so focused on delivering exceptional creative work that he treated invoicing as an afterthought. His follow-up was inconsistent, and his invoices were unclear. This created a preventable business crisis.

Let's be clear: your work is not finished until the invoice is paid. Invoicing is not an awkward request for money; it is a standard business function critical to your cash flow and survival. An unclear or unprofessional process leads to payment delays. This guide provides a professional process.

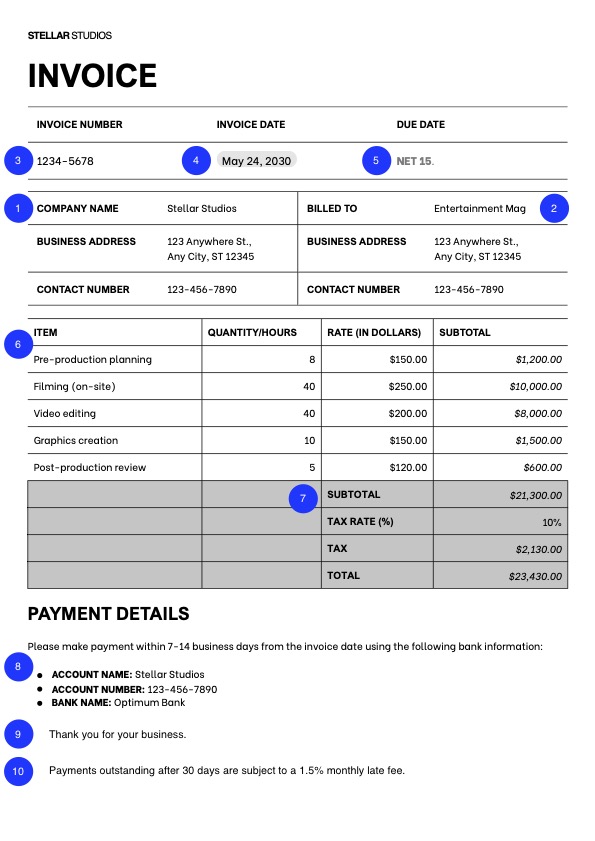

Anatomy of a Professional Invoice: The 10 Essential Elements

A professional invoice eliminates questions and reduces payment friction. Including these 10 items will prevent 90% of delays. Your goal is to make it as easy as possible for your client's accounts payable department to process your invoice without having to contact you for clarification.

- Your Business Information: Your full name or business name, address, and contact information.

- Client's Information: The full legal name and address of the client company you are billing.

- A Unique Invoice Number: Critical for tracking. Use a simple sequence (e.g., INV-001, INV-002) and never reuse a number.

- Invoice Date: The date the invoice is issued.

- Payment Due Date: Clearly state when payment is expected. "Due upon receipt" is acceptable, but specifying a term like "Net 15" or "Net 30" (due in 15 or 30 days) is standard business practice.

- A Detailed List of Services Rendered: Do not just write "Marketing Services." Itemize the work clearly.

- Good Example:

Blog Post: "The Freelancer's Armor" - 1,500 words: $XConsulting Call - 60 minutes (Project Kickoff): $Y

- Good Example:

- Subtotal, Taxes, and Grand Total: A clear mathematical breakdown of the final amount due.

- Payment Terms & Accepted Methods: Restate how you accept payment, as defined in your contract. Provide your bank transfer details, a link for online payment via Stripe, or other relevant information. Make it easy for them to pay you.

- A Brief, Polite "Thank You": A simple "Thank you for your business." is sufficient.

- Your Late Fee Policy (Optional but Recommended): A brief restatement of the late fee clause from your contract (e.g., "Payments outstanding after 30 days are subject to a 1.5% monthly late fee.").

The Invoicing Process: A System, Not an Afterthought

Invoicing should be a repeatable system.

- When to Send: Immediately upon project completion or at agreed-upon milestones, as outlined in your contract. Do not wait. The sooner you send the invoice, the sooner it enters the client's payment cycle.

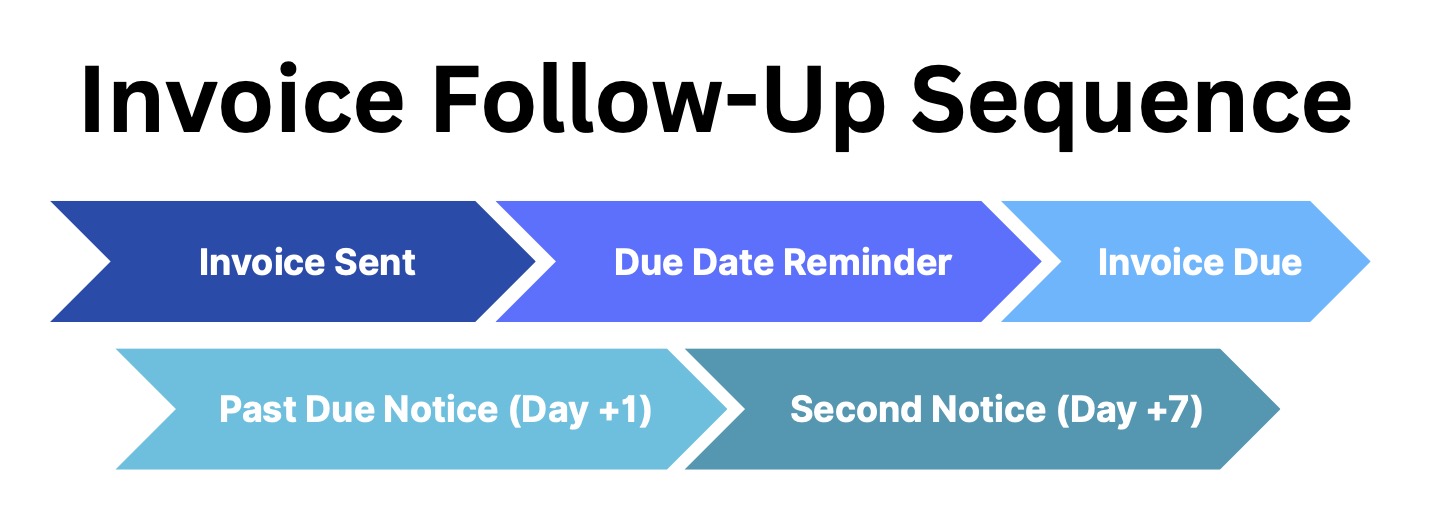

- The Follow-Up Sequence: A lack of follow-up is why my photographer friend almost went out of business. Do not assume a client will remember. A professional, automated-sounding follow-up sequence is standard practice.

- Gentle Reminder: Send a polite reminder email 1-2 days before the due date.

- Past Due Notice: Send a direct but professional "Past Due" notice the day after it's due.

- Second Notice: Send a firmer follow-up 7-10 days after the due date, referencing your late fee policy if applicable.

Tools That Automate the Process

Manual invoicing and tracking in a spreadsheet are acceptable when you have one or two clients. It does not scale and is prone to human error.

To operate professionally, use accounting software. Tools like QuickBooks Self-Employed, FreshBooks, or Wave automate this entire process. They generate professional invoices, track which are paid or overdue, send automatic payment reminders, and allow clients to pay online directly from the invoice with a credit card or bank transfer. This reduces friction and accelerates your cash flow.

Conclusion

You are not a bill collector; you are a business owner managing your accounts receivable. My friend the photographer learned that lesson just before it was too late. He implemented a strict invoicing process, got his cash flow under control, and now runs a more profitable and far less stressful business.

A professional invoicing system is not optional. It is a core function that ensures the money you earn through your hard work and talent actually makes it into your bank account.

- Chip Olson